Voicebot in banking:use cases and implementation guide for modern financial institutions

Voicebot in banking:use cases and implementation guide examines how financial institutions are using AI-driven voice automation to manage growing service demand, multilingual customer bases, and strict regulatory requirements. In global markets, banks and insurance providers continue to rely heavily on voice communication for payment reminders, policy ations, and customer verification.

Instadesk Voicebot is designed to support these real-world banking needs, enabling scalable, compliant, and consistent voice operations without increasing operational complexity or staffing pressure.

Why Voice Still Matters in Banking Services

Despite the rapid growth of digital channels, voice remains one of the most trusted and widely used communication methods in banking. Customers are more likely to respond to voice calls when dealing with sensitive matters such as payments, insurance renewals, or account ations.

In many Southeast Asian markets, voice communication plays a critical role for several reasons:

Customers expect real-time clarification for financial matters

Regulatory processes often require explicit ation

Multilingual populations prefer localized spoken communication

For financial institutions operating across multiple countries, maintaining reliable voice services is not optional. It is a foundational requirement. This is where scalable Voicebot solutions become essential.

The Operational Limits of Traditional Banking Call Centers

Traditional call centers face increasing strain as banking operations expand across regions.

Multilingual agent teams are expensive to maintain, especially when services must cover multiple time zones. Night shifts and peak-hour demand create service gaps that are difficult to fill with human agents alone. At the same time, compliance requirements demand consistent wording, approved scripts, and strict control over outbound communication.

Manual processes struggle to meet these expectations at scale. Inconsistent service quality, delayed responses, and rising labor costs are common challenges. Instadesk Voicebot addresses these issues by introducing structured, automated voice workflows designed specifically for regulated financial environments.

Core Voicebot Capabilities Built for Banking

Instadesk Voicebot focuses on practical capabilities that align with real banking and insurance operations rather than experimental features.

Multilingual Voice Automation

Instadesk Voicebot supports multiple languages used in financial services, including English, Malay, and Japanese. This allows institutions to serve customers across Malaysia, Thailand, Indonesia, Vietnam, and Singapore without building separate call teams for each market.

Voice interactions are localized to ensure clarity and cultural relevance, helping maintain trust while reducing reliance on multilingual human agents.

Compliance and Sensitive-Word Control

Banking voice interactions must comply with strict regional regulations. Instadesk Voicebot includes sensitive-word filtering and compliance logic that can be adjusted based on local requirements.

This ensures outbound calls follow approved scripts, reducing regulatory risk while maintaining operational efficiency. Compliance controls are embedded directly into the Voicebot workflow, rather than relying on manual monitoring.

NLP, ASR, and TTS Integration

Instadesk Voicebot combines natural language processing, accurate speech recognition, and natural voice synthesis. This allows the system to understand customer intent, process responses reliably, and deliver smooth, professional voice interactions suitable for financial contexts.

Common Voicebot Use Cases in Banking and Insurance

Based on documented deployments, Instadesk Voicebot supports several high-impact banking scenarios.

Payment and Renewal Reminders

Voicebots handle large volumes of outbound reminder calls, ensuring customers receive timely notifications. This improves response rates while freeing human agents from repetitive outreach tasks.

Policy and Account Confirmations

Standardized ation calls are managed by the Voicebot, ensuring accuracy and consistency across regions. This reduces manual errors and supports regulatory documentation requirements.

24/7 Voice Service Coverage

Instadesk Voicebot operates continuously, allowing financial institutions to provide round-the-clock voice services without staffing overnight call shifts. This is particularly valuable for institutions serving customers across different time zones.

Measurable Results from Financial Voicebot Deployment

In real-world financial service deployments documented in your materials, the use of Voicebot technology delivered clear and measurable outcomes:

Signing or ation rates increased by over 20%

Labor costs were reduced by approximately 30%

Outbound call efficiency improved by around 50%

Continuous 24/7 multilingual voice service was achieved

These results demonstrate how Voicebot adoption directly improves both customer engagement and operational efficiency in banking environments.

Where Voicebots Add Value — and Where They Should Not

Voicebots are not designed to replace all human interactions in banking. Their value lies in handling structured, repeatable, and high-volume voice tasks.

Voicebots are well-suited for reminders, ations, and notifications with clear rules and defined outcomes. More complex financial consultations, dispute handling, or advisory services should remain with human agents.

Instadesk positions Voicebot technology as part of a hybrid service model, allowing institutions to automate routine voice interactions while reserving human expertise for high-value conversations.

Implementation Guide: Deploying Voicebots in Banking Operations

Successful Voicebot deployment requires careful planning and structured execution.

Phase 1: Pilot High-Volume Use Cases

Financial institutions should begin with scenarios such as payment reminders or policy ations. These use cases offer clear metrics and predictable workflows, making them ideal for initial deployment.

Phase 2: Configure Compliance and Language Rules

Instadesk allows compliance logic to be configured by region. Institutions can align Voicebot scripts with local regulatory requirements across Malaysia, Thailand, Indonesia, Vietnam, and Singapore.

Phase 3: Scale Across Regions and Time Zones

Once validated, Voicebot operations can be expanded across markets. Centralized configuration ensures consistent service standards while allowing localized execution.

Deploying Voicebots Across Southeast Asian Banking Markets

Banking operations in Southeast Asia present unique challenges. Languages, regulations, and customer expectations vary significantly between countries.

Instadesk Voicebot is designed to support these regional differences through flexible configuration and multilingual capabilities. By aligning voice workflows with local requirements, institutions can scale operations without fragmenting service quality.

This approach supports regional expansion while maintaining consistent compliance and customer experience standards.

Why Financial Institutions Choose Instadesk

Instadesk is built for enterprise-scale, compliance-sensitive environments. Its Voicebot solution focuses on reliability, regulatory alignment, and operational clarity.

Rather than offering generic automation, Instadesk provides financial institutions with a structured voice infrastructure that integrates seamlessly into existing service operations. This makes it suitable for banks and insurers planning long-term digital transformation rather than short-term experimentation.

Building the Future of Voice-Driven Banking

Voicebot adoption in banking is no longer an emerging trend. It is becoming a core component of modern financial service infrastructure. As customer expectations rise and regulatory requirements tighten, institutions need voice solutions that are scalable, compliant, and dependable.

With Instadesk Voicebot, banks and insurance providers gain a practical path toward modernizing voice operations while maintaining trust, control, and operational efficiency across Southeast Asian markets.

Tags

Issac

Omnichannel Digital Operations: Driving Traffic Growth & Deepening User Value

You may also like

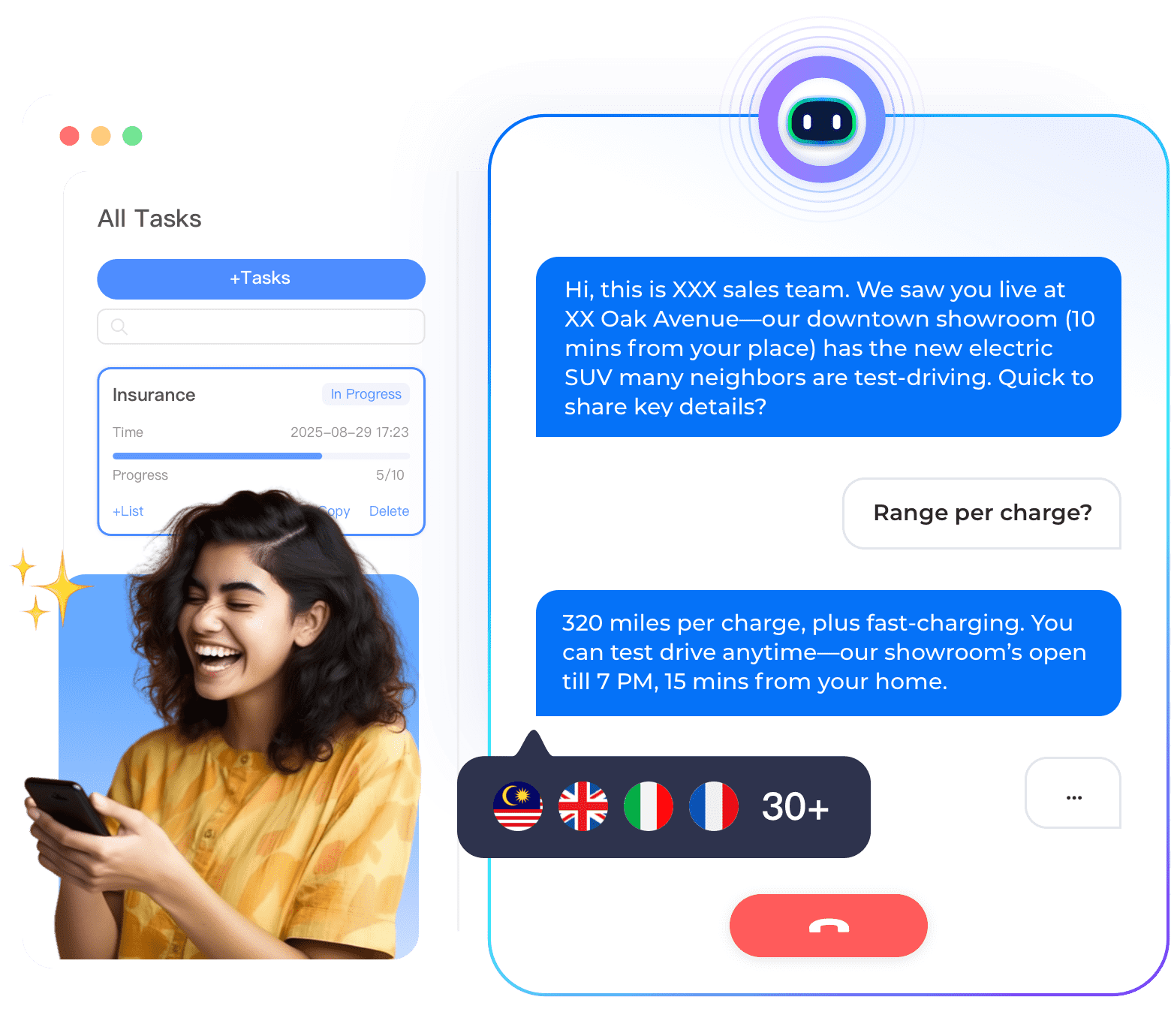

How Voice Bot Solves 4 Core Pain Points for a Leading NEV Manufacturer

A well-known new energy automobile brand is a global pioneer in intelligent mobility, upholding the concept of "Intelligence Drives Experience" and winning global consumer trust with eco-friendly, high-performance vehicles and user-centric, tech-driven services.

Guide to VoiceBot: What is it? Functions and Brand Recommendations for Multi-Country Service Teams

When teams search for Guide to VoiceBot: What is it? Functions and Brand Recommendations, they are usually not looking for a definition alone. They want to understand how VoiceBot actually works in real customer service operations, how it connects with tickets and workflows, and whether it can handle multilingual, high-volume conversations across different countries.

How Zeelool Scaled Global Customer Service with Instadesk AI VoiceBot

Zeelool adopted Instadesk AI Voicebot and omnichannel platform to solve fragmented global customer service issues. It boosted service efficiency, expanded market coverage, and turned customer service into a core competitive advantage for the brand.

Get Started in Minutes. Experience the Difference.